On 9 April 2020, the Coronavirus Economic Response Package (Payments and Benefits) Act 2020 was enacted which gives effect to the Government’s $130 billion JobKeeper payment scheme.

The scheme was announced on 30 March 2020 by the Prime Minister and the Treasurer in a joint media release and was both tabled and passed without amendment by the Parliament on 8 April 2020. It is part of the Government’s $320 billion total economic stimulus and support package for businesses and workers affected by the trade restrictions imposed by the Coronavirus (COVID–19) crisis.

The purpose of the scheme is to keep people employed even though the business they work for may go into ‘hibernation’ and close down for a temporary period.

Businesses impacted by the Coronavirus will be able to access a wage subsidy from the Government to assist in continuing to pay their employees. Eligible employers will be able to claim a fortnightly payment of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months.

The Government anticipates that around 6 million workers will benefit from the JobKeeper payment, or around half of the Australian workforce. The payment will provide the equivalent of around 70 per cent of the national median wage.

For workers in the accommodation, hospitality and retail sectors — which are among the worst sectors hit — it will equate to a full median replacement wage.

The subsidy started on Monday, 30 March 2020 — i.e. that is when eligible employers could begin to make payments that are eligible for the wage subsidy.

The JobKeeper payment scheme will end on Sunday, 27 September 2020 (13 fortnights from 30 March 2020).

Reference — Treasury fact sheets

JobKeeper Payment — Supporting businesses to retain jobs (last updated 11 April 2020)

JobKeeper Payment — Information for employers (last updated 11 April 2020)

JobKeeper Payment — Information for employees (last updated 11 April 2020)

JobKeeper Payment — Frequently asked questions (last updated 11 April 2020)

Legislative Framework

On 8 April 2020, the Coronavirus Economic Response Package of four bills was tabled and passed by Parliament. This package follows the Government’s previous $190 billion Coronavirus economic stimulus package which received Royal Assent on 24 March 2020.

The package of bills received Royal Assent on 9 April 2020 and comprises the following Acts:

- Coronavirus Economic Response Package (Payments and Benefits) Act 2020 (the Payments and Benefits Act) — Act No. 37 of 2020

- Coronavirus Economic Response Package Omnibus (Measures No. 2) Act 2020 (the Omnibus Act) — Act No. 38 of 2020

- Appropriation Act (No. 5) 2019–2020 — Act No. 39 of 2020

- Appropriation Act (No. 6) 2019–2020 — Act No. 40 of 2020

There is a common Explanatory Memorandum that accompanies all of the bills.

The Payments and Benefits Act — establishing the JobKeeper Scheme

The Payments and Benefits Act establishes a legislative framework to administer the JobKeeper payments but does not contain the detailed rules which determine the operation of the JobKeeper scheme. Under the legislative framework, the Treasurer is permitted to make rules to provide for the JobKeeper payments. The Act sets out the matters in relation to which the Treasurer may make rules.

The Payment and Benefits Act gives a specific legislative authority to the Commissioner of Taxation who will administer the JobKeeper program.

The Treasurer’s rules

On 9 April 2020, a legislative instrument titled the Coronavirus Economic Response Package (Payments and Benefits) Rules 2020 (the Rules), setting out the Treasurer’s rules to give effect to the JobKeeper scheme, was registered (F2020L00419). The instrument is accompanied by an Explanatory Statement.

ATO Guidance

On 14 April 2020, the ATO released a suite of online fact sheets providing guidance on the operation of the JobKeeper scheme. It will continue to release guidance materials as they become available.

Reference — ATO Fact Sheets

For employers and business owners (QC 62126)

For employees (QC 62134)

For tax professionals (QC 62139)

This article summarises the Rules and incorporates supporting commentary from the explanatory materials, the Treasury fact sheets, and the ATO fact sheets, as well as relevant aspects of the Payments and Benefits Act and Omnibus Act.

Amendments to the Fair Work Act to Support the JobKeeper Scheme

Schedule 1 to the Omnibus Act inserts new Part 6-4C into the Fair Work Act 2009 (the FW Act) to support the operation of the JobKeeper scheme. The amendments commence on 9 April 2020 and will automatically be repealed on 28 September 2020 (i.e. the day after the JobKeeper scheme ceases).

The Fair Work Commission (FWC) will be able to resolve disputes relating to these new temporary rules, including by arbitration. Further, on 8 April 2020, the FWC made determinations varying 99 awards to provide unpaid pandemic leave and greater flexibility for annual leave for employees in many awards.

Reference

For further information on the Fair Work changes, refer to:

- Fair Work Ombudsman webpage — Coronavirus and Australian workplace laws

- Fair Work Commission webpage — Coronavirus (COVID–19) updates & advice

Eligibility criteria

Eligibility Based on Paid Employees — Eligible Employer

An employer is entitled to the JobKeeper payment in respect of an individual (an employee) in relation to a fortnight if it meets seven conditions which are discussed below.

Important

Employers must elect to take part in the JobKeeper scheme. It is not mandatory for eligible employers to participate.

Condition 1 — the fortnight is a JobKeeper fortnight

A JobKeeper fortnight is defined as:

- the fortnight beginning on Monday, 30 March 2020 (i.e. and ending on Sunday, 12 April 2020);

- each subsequent fortnight, ending with the fortnight ending on Sunday, 27 September 2020.

Condition 2 — Qualifies on or before the end of the fortnight

An entity qualifies for the scheme at a particular time if:

- on 1 March 2020, the entity either:

- carried on a business in Australia; or

- was a non-profit body that pursued its objectives principally in Australia; and

- the entity has satisfied the decline in turnover test at or before that time (see below).

Qualifying entities must report monthly turnover information to the Commissioner for the duration of the scheme. This does not mean the entity has to keep satisfying the decline in turnover test to remain eligible for the duration of the scheme.

Entitlement on a Prospective Basis

The JobKeeper scheme operates on a prospective basis only. Entitlement only arises for JobKeeper fortnights and later fortnights in which eligible employers are registered under the scheme prior to the end of a fortnight.

If an employer does not become eligible until later in the JobKeeper period, they cannot backdate or claim JobKeeper payments back to 30 March 2020.

However, there is an exception for the month of April 2020. Employers may register prior to the end of April, and if they meet the eligibility rules, they will receive JobKeeper payments in relation to the first two JobKeeper fortnights (i.e. 30 March to 12 April, and 13 April to 26 April).

Ineligible Entities

Certain entities cannot qualify for the JobKeeper scheme, including:

- an entity that is subject to the Major Bank Levy (or a member of their consolidated group);

- government entities;

- a company in liquidation;

- an individual in bankruptcy.

Condition 3 — Eligible employees

An individual is an eligible employee of their employer for a fortnight where:

- they are employed by the entity at any time in the fortnight (including those stood down or re-hired — see below);

- on 1 March 2020 — they were aged 16 years or over, and was either:

- a full-time or a part-time employee of the entity; or

- a ‘long term casual employee’ of the entity — i.e. they had been employed by the entity on a ‘regular and systematic basis’ during the period of 12 months ending on 1 March 2020. A long term casual employee cannot be an employee (other than a casual employee) of another entity.;

- on 1 March 2020, they were either:

- an Australian resident (for social security law purposes); or

- a tax resident and held a special category Subclass 444 visa (for New Zealanders).

- they agree to be nominated by the employer as an eligible employee for the purposes of the JobKeeper scheme.

Excluded from Being an Eligible Employee

An individual is excluded from being an eligible employee for a fortnight:

- to the extent that they are receiving the Government’s parental paid leave in relation to that fortnight (however, employees on paid or unpaid parental leave from their employer may be eligible);

- if they receive the Government’s dad and partner pay at any time during the fortnight; or

- where they are totally incapacitated for work throughout the fortnight and they are eligible for workers’ compensation payments in respect of that incapacity. The Treasury fact sheet states that employees receiving workers compensation payments may be eligible if the employer has an obligation to pay some component of their salary or wages — e.g. where they are still working but on reduced hours.

The individual must give their employer a ‘nomination notice’ in the approved form. It needs to be returned to the employer by the end of April in order for the employer to claim JobKeeper for April.

Website

Employee nomination notice — ATO form (QC 62163)

Employer Notification

Employers must advise their employees whether they have been nominated as an eligible employee, within seven days of notifying the Commissioner of the individual’s details.

Stood Down Employees

Employers can claim JobKeeper for employees that were stood down after 1 March 2020. Even if they remain stood down, the employer must nevertheless pay them a minimum of $1,500 per fortnight in order to remain eligible.

Re-hired Employees

Where the employer let employees go after 1 March 2020 but subsequently re-hired them, the employer can claim JobKeeper in relation to these employees. This is the case even if the employer needs to immediately stand them down, so long as they are employed. The employees must have been employed by the same employer on 1 March 2020 and let go only after that date.

New Employees

Employees who were not engaged by the employer on 1 March 2020 are not eligible.

Condition 4 — Wage Condition

The employer satisfies the wage condition in respect of an employee for a fortnight if the sum of the following amounts equals or exceeds $1,500:

- amounts paid to the employee as salary, wages, commission, bonuses or allowances;

- amounts withheld under the PAYG withholding rules for employees;

- salary sacrificed superannuation contributions paid to a superannuation fund or a retirement savings account;

- other salary sacrificed amounts that reduce the employee’s salary, wages, commission, bonuses or allowances.

Where the employer’s pay run period is usually longer than a fortnight, those payments can be allocated to one or more fortnights in a ‘reasonable manner’ for the purposes of the wage condition. For example, if an employer’s ordinary arrangement is to pay an employee every four weeks, it may be reasonable for the purposes of satisfying the wage condition if the employee is paid at least $3,000 for every four-week period.

The Commissioner has a discretion to treat a particular event as having happened in a different fortnight(s) to the extent that it is reasonable to do so in his opinion. For example, an employee may be accidently underpaid in a fortnight with the result that the employee is paid less than $1,500 in that fortnight, and then receives back pay in the next fortnight in recognition of the underpayment. If this occurs the Commissioner may decide that it is reasonable to treat the employee as having received at least $1,500 in the earlier fortnight.

Condition 5 — Notification of Election to Participate

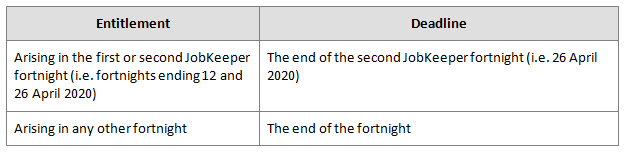

The employer must notify the Commissioner that it elects to participate in the JobKeeper scheme at or before the following times:

Condition 6 — Information Given to the Commissioner

The employer is required to give information about the entitlement for the fortnight, including details of the individual, to the Commissioner, in the approved form.

It is expected the ATO will provide further guidance on this requirement.

Monthly Reporting Requirement

An entity that is entitled to a JobKeeper payment for a fortnight must also notify the Commissioner in a monthly JobKeeper Declaration report within seven days of the end of the calendar month in which the fortnight ends of the entity’s:

- current GST turnover for the reporting month; and

- projected GST turnover for the following month.

Condition 7 — No notification of ceasing participation

An employer is not entitled to the JobKeeper payment if they notify the Commissioner that they no longer wish to participate in the JobKeeper scheme. This notification must be made in the form approved by the Commissioner.

The Turnover Tests

The Decline in Turnover Test

Turnover for this purpose is calculated on the same basis as it is for GST purposes.

The decline in turnover test operates by comparing:

- the entity’s projected GST turnover for a turnover test period; with

- the entity’s current GST turnover for a relevant comparison period.

The Turnover Test Period and Relevant Comparison Period

The turnover test period is:

- a calendar month that ends after 30 March 2020 and before 1 October 2020 — i.e. from March 2020 to September 2020 (note: March has 31 days so it ends after 30 March 2020); or

- a quarter that starts on 1 April 2020 or 1 July 2020 — i.e. the June 2020 or September 2020 quarters.

The relevant comparison period is the comparable month or quarter in 2019 that corresponds to the entity’s turnover test period.

For example, a business can compare either:

- the whole of the month of March 2020 with March 2019; or

- the June 2020 quarter with the June 2019 quarter.

Test to Be Satisfied Only Once

Once an entity satisfies the decline in turnover test and becomes eligible at a time (subject to meeting all of the other eligibility conditions), there is no requirement to retest in later months.

Where an entity does not qualify for the month of March or April 2020, it can become eligible in a later month.

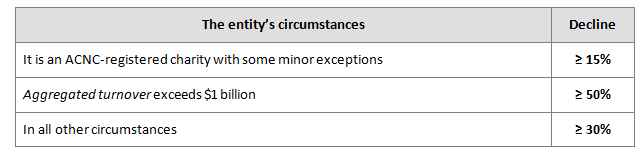

How Much Does the Turnover Need to Decline By?

Important

The first turnover test ($1 billion threshold) is the entity’s aggregated turnover as worked out under s. 328-115 of the ITAA 1997 — i.e. the entity’s annual turnover is grouped with the annual turnover of its affiliates and entities connected with it. Therefore, a small business that forms part of a group that has an aggregated turnover of more than $1 billion must have at least a 50 per cent decline in turnover.

However, the second turnover test (the percentage decline in turnover) relies solely on the entity’s GST turnover which is not grouped.

Decline in Turnover: The Basic Test

An entity must establish that its turnover has decreased by what the Rules refer to as the ‘specified percentage’ — i.e. either 15 per cent, 30 per cent or 50 per cent (as relevant). In this article, the expression ‘30 per cent’ also refers to ‘15 per cent’ and ‘50 per cent’ unless context requires otherwise.

Decline in Turnover: Alternative Test

The basic test may not accurately reflect the downturn in activity that the business has suffered. The Rules provide the Commissioner with discretion to set out an alternative test, by legislative instrument, that applies to a class of entities where the Commissioner is satisfied that there is not an appropriate relevant comparison period in 2019.

For example, a business may not have been in operation a year earlier, or their turnover a year earlier is not representative of their usual or average turnover perhaps because there was a large interim acquisition, they were newly established, were scaling up, or their turnover is typically highly variable.

It will be necessary for the affected entity to provide appropriate evidence to the Commissioner that it satisfies the alternative test.

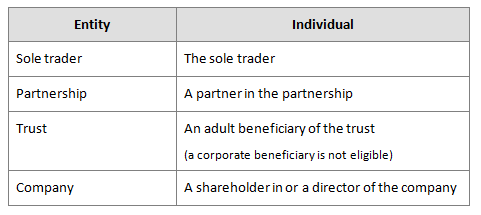

Eligibility Based on ‘Business Participants’ Who are Not Employees

The Rules also allow a limited entitlement to the JobKeeper payment for certain individuals who are not employees of these entities but who are actively engaged in the business carried on by a sole trader, partnership, trust or company (i.e. not passive partners, shareholders and beneficiaries):

Requirements of The Individual

In relation to a fortnight, the individual must be ‘actively engaged’ in the business carried on by the entity. They cannot also be an employee of the entity at any time during the fortnight.

The individual must have met the following conditions on 1 March 2020:

- they were aged 16 years or over;

- they were actively engaged in the business;

- their relationship to the entity was as outlined in the above table;

- they satisfy specified residency requirements:

Certain individuals are ineligible.

The individual must give their entity a ‘nomination notice’ in the approved form, and at the time of the nomination, they cannot be an employee (other than a casual employee) of another entity.

Integrity Rule

An entity is not entitled to a JobKeeper payment for an eligible business participantunless:

- the entity had an ABN on 12 March 2020 (or a later time allowed by the Commissioner) — i.e. an entity that is recently created to access the JobKeeper payment will not qualify; and

- either:

- an amount was included in the entity’s assessable income for the 2018–19 income year in relation to it carrying on a business, and the Commissioner was notified on or before 12 March 2020 (or a later time allowed by the Commissioner); or

- the entity made a taxable supply in a tax period that started on or after 1 July 2018 and ended before 12 March 2020, and the Commissioner was notified on or before 12 March 2020 (or a later time allowed by the Commissioner).

Implications for Employees and Employers

Employees

Employee Obligations

Employees will receive a notification from their employer that they are receiving the JobKeeper payment. Most employees will need to do nothing further. However, employees in the following circumstances will have additional obligations:

- Employees who have multiple employers must notify the employer that is their primary employer.

- Employees who are not Australian citizens must notify their employer of their visa status, to allow their employer to determine if they are an eligible employee.

- Employees who are currently in receipt of, or have applied for, an income support payment should advise Services Australia of their change in circumstances.

Tax Implications for the Employee

The amounts paid by the employer are treated as assessable salary and wages in the hands of the employee.

Employers

Tax Implications for the Employer

JobKeeper payments received by an employer will be included in the employer’s assessable income as wage subsidies under s. 15-10 of the ITAA 1997.

The normal rules for deductibility apply in respect of the amounts a business pays to its employees where those amounts are subsidised by the JobKeeper payment (e.g. payments of salaries and wages are generally deductible to the employer under s. 8-1 of the ITAA 1997).

The JobKeeper payment is not subject to GST.

Payments

Payment Periods

Employers will need to satisfy payment requirements in respect of each 14-day period covered by the JobKeeper scheme from Monday, 30 March 2020 to Sunday, 27 September 2020.

The first period commenced on Monday, 30 March 2020 and ended on Sunday, 12 April 2020. The final period will start on Monday 14 September 2020 and end on Sunday 27 September 2020.

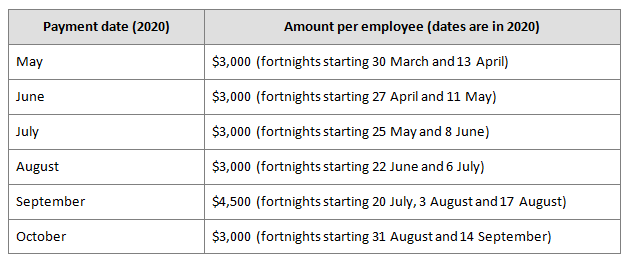

Payment schedule

The ATO has produced a payment schedule:

JobKeeper Payment to Employers

JobKeeper payments will be made to employers monthly in arrears by the ATO. The first payments will be paid by the ATO in the first week of May 2020.

The Commissioner must make the payment no later than the later of:

- 14 days after the end of the calendar month in which the fortnight ends; and

- 14 days after the Commissioner is satisfied that the entity is entitled to a payment for a fortnight.

This means that, while entitlement to a payment is assessed in relation to a JobKeeper fortnight and the amount is a fortnightly amount, an entitled employer or business will receive the JobKeeper payment monthly. For example, a participating employer with one eligible employee who qualifies for both fortnights in June 2020 will generally receive $3,000 by 14 July 2020.

The JobKeeper payment cannot be claimed for employees who were not paid the full amount of $1,500 for the fortnight. Further, the payment is a reimbursement and cannot be paid in advance.

Employers’ Payments to Employees

For the first two fortnights, the ATO will accept the minimum $1,500 payment before tax has been paid for each fortnight even if it has been paid late, provided it is paid by the end of April.

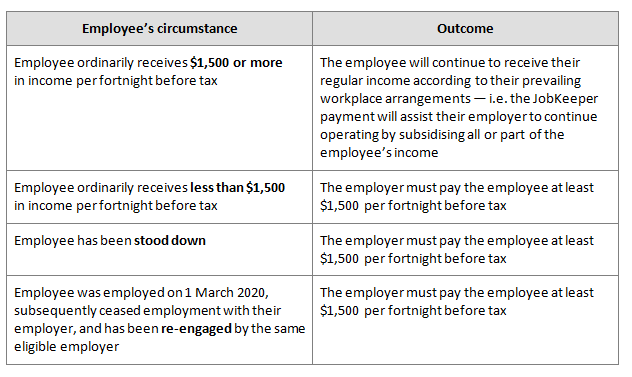

Where employers participate in the scheme, their employees will receive the JobKeeper payment as follows:

PAYG Withholding

The minimum payment of $1,500 per fortnight to an eligible employee is salary or wages for the purposes of the PAYG withholding rules. The employer must withhold and remit tax as appropriate.

The ATO’s PAYG withholding tables are available here. The ATO’s tax withheld calculatorsare available here.

Superannuation Guarantee (SG)

Where an employer receives the JobKeeper payment to subsidise the salaries and wages they ordinarily pay to eligible employees, these payments of salaries and wages remain subject to the usual SG obligations.

However, an employer will not be required to make SG contributions for an employee for JobKeeper payments made to employees. This includes employees who are stood down because employers have no obligation to pay salaries and wages to stood down employees.

It will be up to the employer if they want to pay superannuation on any additional wage paid because of the JobKeeper Payment.

Cash Flow Implications

The Government suggests that where paying employees until the employer is reimbursed by the ATO in early May presents cash flow difficulties, those businesses should consider speaking to their bank to discuss their options. The banks have said businesses may be able to use the upcoming JobKeeper payment as a basis to seek credit in order to pay their employees until the first payments begin to flow from the ATO under the scheme.

JobKeeper Payments to Sole traders

Sole traders will receive a monthly payment from the ATO in their bank account.

Overpayments

An employer that receives a JobKeeper amount to which it was not entitled or that was more than the entitlement is liable to repay the amount plus General interest charge (GIC).

Interaction with Other Stimulus Measures

The Apprentice Subsidy

An employer that receives the JobKeeper payment in respect of an employee is not eligible to also receive the 50 per cent wage subsidy for apprentices and trainees at the same time. The business can receive the apprentice subsidy from 1 January 2020 to 31 March 2020, and then the JobKeeper Payment from 1 April 2020 onwards.

The Cash Flow Boost

It appears that there is nothing in the JobKeeper legislative framework or the Rules which prevents an eligible employer from claiming the Cash Flow Boost in relation to payments made to eligible employees under the JobKeeper scheme. It is expected that the ATO will provide guidance on this issue.

Integrity Rule — Contrived Schemes

The Rules contain an integrity measure which allows the Commissioner to determine that the recipient never became entitled to the payment, or that the amount to which the recipient was entitled was a different amount where the entity entered into or carried out the scheme for the sole or dominant purpose of obtaining or increasing the amount of the JobKeeper payment.

Administrative Matters

Application for the JobKeeper Payment

Eligible employers can apply for the JobKeeper payment by way of an online application and must provide supporting information demonstrating a downturn in their business.

Businesses or their registered tax agents can enrol from 20 April 2020 through the ATO Business Portal, or ATO Online services for agents, as appropriate.

Eligible employers will need to identify eligible employees for JobKeeper payments and must provide monthly updates on their eligible employees to the ATO.

Compliance

The program will be subject to ATO compliance and audit activities. There will be a positive obligation on employers to establish eligibility. Employers and individuals that breach the JobKeeper rules may be subject to penalties imposed by the ATO and/or FWC.