Business in a Post Pandemic Environment

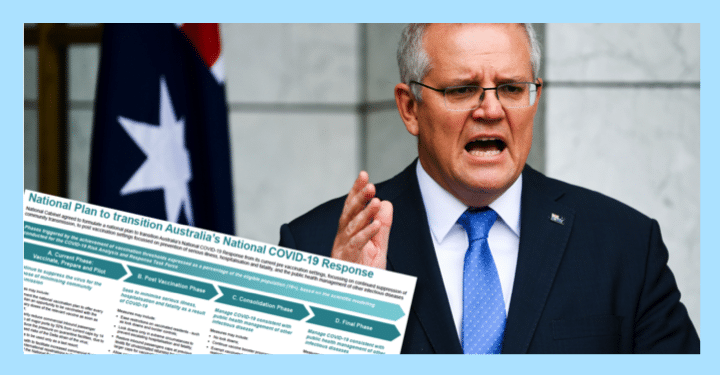

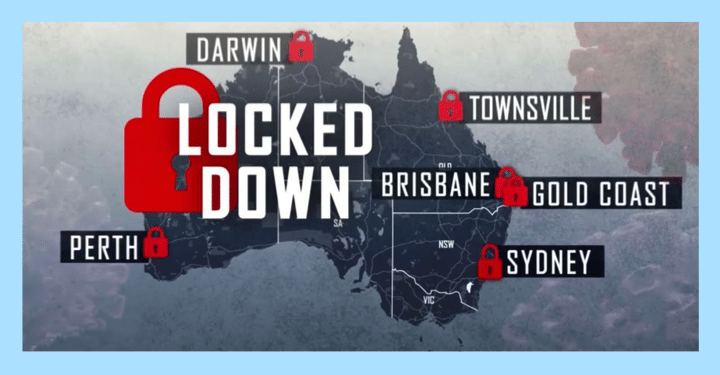

Countries that have experienced the worst of the pandemic give Australian businesses an insight into what to expect in a post-lockdown environment. Australia, like New Zealand, has managed COVID-19 on an elimination basis. That is, lockdowns and border closures to keep the virus out. And, it has worked comparatively well with New Zealand suffering 26…