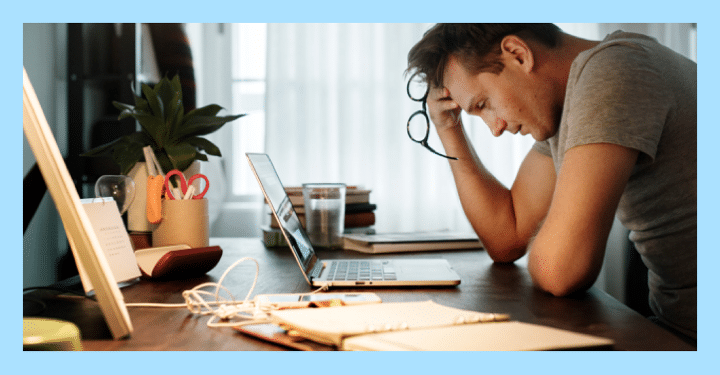

What Expenses Can I Claim Whilst Working From Home?

There has been a significant push in recent times for businesses to offer the option to work from home due to the global pandemic and various lockdown restrictions due to COVID-19. The transition to working from home has come with a number of benefits for workers, including a more convenient working lifestyle and the removal…