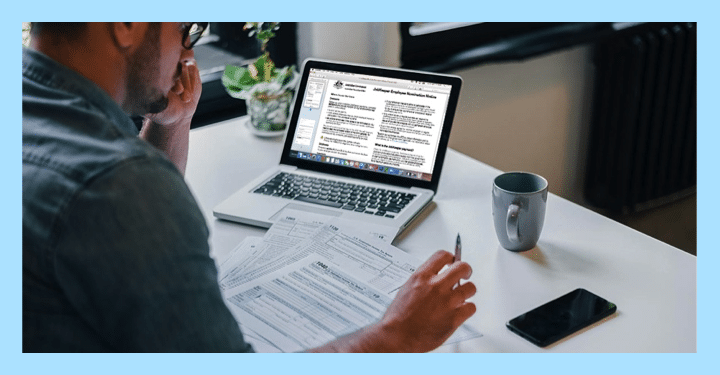

COVID-19 | ‘Hundreds’ to be Contacted in ATO Early Super Compliance Blitz

Hundreds of Australians who applied for the COVID-19 early release of superannuation are set to be queried on their eligibility as the ATO kicks off a pilot compliance program. The ATO will now contact “hundreds” of people who appear to have been ineligible for the early release of super but have gone ahead to raid their…